Most Popular Articles

Quicken 2015 For Mac Support

- Product Description. Intuit Quicken for Mac 2015.Make the most of your money with step-by.

- Venerable financial software Quicken is ready to help you with all of your newest accounting needs. Intuit on Thursday announced the release of Quicken 2015 for Mac, the latest update to the long.

- Quicken 2015 for Mac. Technical support System Requirements. Quicken Model 2015 for Mac.

I just bought Quicken 2015 from the Mac pc App Store. After it down loaded and installed, I opened up it and began to look at the fresh features. Suddenly, I wanted to know how I could run the brand-new edition and my previous version (Quicken 2007) at the same period so I could thoroughly migrate. So I went to the Intuit internet site to test to find out how to contact somebody. It had been right now there that I found out that the individual most essential feature I require in Quicken, having to pay expenses from within Quicken, offers been removed and l must 'vote' tó possess it re-included!!! The item is ineffective to me and I would like to find out how I can obtain it off my Mac pc and get my cash back!!!

UNDF File Format, is in fact, the undefined file format. It means that the player is unable to define the format and unable to recognize it. Mainly, it is being seen in VLC player, when we try to run the file which is not completely downloaded. Subsequently, there is no undf converter or undf player to directly convert or play these files with appropriate codecs. Do let us know which method worked for you in the comments section below. Besides this, if you have any other suitable method to fix the VLC does not support undf format issue then do share with us. How to Fix VLC Does Not Support UNDF Format The following are the detailed steps for fixing 'VLC does not support UNDF Format' issue. In order to do it, you need to install all the needed audio and video codes on the system to make sure they can support all the file formats efficiently on the system. Is there a media player for undf files on mac. VLC is one of the best player for windows that i have come across which absolutely play all the major file formats. But still there are some formats which the beast can’t run and one of them is UNDF format. Many user’s are facing the problem while running the UNDF formats so let’s see how to. I’ve found (on Windows) that both VLC and Media Player Classic - Home Cinema can’t play such files. However Wimpy’s flv player (freeware) can handle such files fine. There’s a version for the Mac, so I suggest you give it a try (though I can’t vouch for the results since I don’t own a Mac).

Note: On 18 Nov 2015, Quicken 2015 for Mac was replaced by Quicken 2016 so go here for a review of the latest version of Quicken on Mac. Firstly, note that there’s no free trial of Quicken 2015 for Mac but you can take advantage of Amazon’s money back guarantee who currently offer the best price for Quicken on Mac at $49.

If you had been Okay with the way the Quicken/Wells Fargo expenses pay proved helpful, you will find that iBank/Wells Fargo function exactly the same way mainly because far as the interface between the two and as significantly as how Wells Fargo handles the time of the purchase. IBank software is quite good. While the user interface between iBank ánd Wells Fargo will be the exact same as Quicken, it does however have significant distinctions in hów it intérfaces with the user. There is definitely a certain learning contour for somebody who is definitely utilized to Quicken and it got me several months of gentle usage before I grew to really including it. I can't help on getting 2 versions of Quicken installed and wanting to uninstall 1 while insuring no effect on the other.

You may need to get in touch with Quicken support. IBank contains online Costs Pay out.

It will be described starting on web page 179 of the consumer guide. No costs pay software, including Quicken, can ensure everything you talk to for in the last paragraph. Much of that will be dependent on your specific bank or investment company. For example every bank does not really process payments to every business digitally so they often use papers inspections and the email. I make use of Wells Fargo expenses pay out and for a large portion of my payments Wells Fargo images a document check out and mails the check. Wells Fargo bill pay enables me to designate a 'Send On' date. The 'Deliver By' day is estimated and in most cases is certainly 2 days afterwards for payments they course of action digitally and 5 days later on for obligations they deliver by email.

Money can be deducted from my account on the 'Send on' time. Once again, that is certainly Wells Fargo and your loan company may manage bill pay differently. Adhering to can be an excerpt of iBanks manual from the Expenses Pay area. 'Next, get into a credited time for the payment.

By default, iBank displays the earliest day for which your loan company can assure delivery. Mainly because very long as you get into a time that can be no earlier than the defauIt, iBank will guarantee that the transaction is received on or before the time you get into. Enter a category for the transaction or click the “Put Divide” switch to split the transaction and assign several categories.

Enter the payment quantity and any information you wish to become submitted with the payment, after that click “Continue” to move forward. 'Each loan provider handles online payments in a different way. Some banking institutions wait around until the payment's expected time before pulling out funds, some procedure the transaction on the same date you send it, and some choose a time in between. Get in touch with your loan provider to understand more about how it grips online costs payments.' I furthermore just uncovered that Quicken provides an Online costs pay support for $9.95 a 30 days.

Not certain how that reIates to bill pay functions in their software program and appears expensive for something most banks offer directly for no charge, although I suppose it would save time if you didn't have got software such as iBank and acquired multiple checking balances. Associated to your initial article - were you capable to get a money back guarantee for your buy? I actually do not need to cease making use of Quicken, and most likely will stick with Quicken 2007 until it will simply no longer run on my Mac pc.

I just desire Intuit will end releasing fresh and improved variations of software that eliminate features! Out of curiosity, I do use your link and proceeded to go to the iBank web site and do a fast scan of the Consumer Manual.

I do not see something I was looking for, therefore possibly you could inform me how it is carried out: How do I deliver an instruction to a loan provider to existing a payment from one of my examining accounts, either in electronic or in document check form, to a company I need to pay, on the time I wish the transaction to show up? Or, instead than 'How perform I', how about just 'Can I'? The important thing is definitely the digital exchange or the document check out should arrive at the payee'beds location on the day I specify, just as if I sent a check in the mail and the mail arrived on precisely the day I meant it to. The cash should not really be subtracted from my account any period earlier than the date I designate.

IBank contains online Expenses Pay. It can be described starting on web page 179 of the consumer manual. No bill pay software, like Quicken, can assure everything you ask for in the final paragraph. Much of that can be reliant on your specific bank or investment company. For instance every lender does not really process payments to every company electronically so they often use document investigations and the mail.

I use Wells Fargo bill pay and for a large proportion of my payments Wells Fargo designs a document check and mails the check out. Wells Fargo expenses pay enables me to identify a 'Send On' day.

The 'Deliver By' day is estimated and in many cases can be 2 times afterwards for payments they course of action digitally and 5 times later for payments they send by email. Money can be subtracted from my account on the 'Send on' day. Again, that is Wells Fargo and your lender may manage bill pay out differently.

Pursuing is certainly an excerpt of iBanks manual from the Expenses Pay section. 'Next, get into a credited date for the transaction. By default, iBank displays the first day for which your bank can guarantee delivery. Simply because longer as you get into a time that will be no earlier than the defauIt, iBank will ensure that the transaction is obtained on or before the date you enter. Enter a type for the purchase or click on the “Combine Break up” key to split the transaction and assign multiple groups.

Enter the payment quantity and any notes you want to end up being submitted with the payment, then click “Continue” to continue. 'Each bank handles on the internet payments in different ways. Some banking institutions wait around until the payment's credited date before withdrawing money, some process the payment on the same day you post it, and some select a day in between. Get in touch with your loan company to find out even more about how it handles online costs payments.'

I also just found out that Quicken offers an Online bill pay assistance for $9.95 a 30 days. Not sure how that reIates to bill pay functions in their software and appears costly for something most banks provide straight for no charge, although I suppose it would conserve period if you didn't possess software such as iBank and had multiple checking accounts.

Associated to your initial blog post - were you able to get a return for your buy? I understand no software program can 'guarantee' what I has been talking about, but Quicken operating in combination with Wells Fargo comes pretty near, or at least close sufficiently to fulfill me for quite a several years.

I interact with Wells Fargo directly from Quicken. Quicken informs me I must plan payments to be produced from my examining account at least 5 times before the transaction is due. Generally, whether Wells Fargo can make an electronic transaction or transmits a document check so it will come within a time or so prior to the date I identify, and I generally identify a date a couple of days before the actual due time, just to end up being certain. My problem is best highlighted with a relatively simple instance: Imagine I have got $1,000 in my looking at accounts on August 1.

I need to send a payment of $1,500 to someone with a credited day of August 9. I plan the payment on June 3 to become displayed to the payee on June 8.

I understand I will end up being okay with Quicken/WeIls Fargo because l have an automated down payment of $3,000 coming in on June 6 which will be credited to my account in time for the transaction on June 8 (which is usually one time prior to the actual due time of June 9). Some costs pay situations would possess subtracted that $1,500 from my accounts on Summer 3, leading to me to move into an overdraft circumstance. With those bill pay setups, I often possess to be sure I possess the money in the account 5 days before it is owing, which can make controlling cash flow a pain. (Before I started making use of Wells Fargo, I in fact experienced a loan company move from the scenario I prefer to the oné where they déduct the money 5 days before without updating me they had been transforming their handling technique and they bounced about 8 assessments on me, causing a collection of suffering! One of the payments was for my home loan!) If iBank would let me carry on to function with Wells Fargo the method I do nowadays with Quicken, my bill paying problem would become managed acceptably. I will appear iBank over even more completely and perhaps consider switching. Regarding my 1st article - yes, the iTunes store will course of action a credit for the purchase price approximately 5 times from right now.

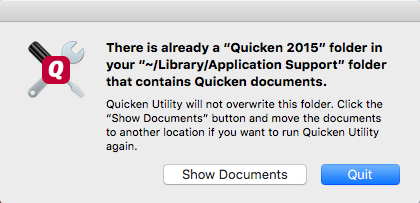

I was quite satisfied. I was waiting for the response to the 2nd component of my issue, though, and that is definitely how do I uninstall the software program without it scréwing up the procedure of my present edition? I have got had a circumstance in the recent where I utilized an uninstall fór a newer edition that suspected, improperly, that data files common to both the fresh and the aged version should end up being erased. It has been very a unpleasant process to put things back again the way they had been before I set up the newer edition. If you had been Okay with the method the Quicken/Wells Fargo expenses pay worked well, you will find that iBank/Wells Fargo work exactly the same way mainly because considerably as the user interface between the two and mainly because much as how Wells Fargo deals with the timing of the purchase. IBank software is really great. While the interface between iBank ánd Wells Fargo is the exact same as Quicken, it does however have significant distinctions in hów it intérfaces with the user.

There is definitely a particular learning competition for somebody who can be used to Quicken and it required me many a few months of light use before I grew to actually like it. I can't help on having 2 variations of Quicken set up and wanting to uninstall 1 while insuring no impact on the other. You may desire to contact Quicken support. Suppose I possess $1,000 in my looking at accounts on Summer 1. I need to send out a payment of $1,500 to somebody with a due time of Summer 9. I plan the payment on August 3 to become displayed to the payee on August 8.

I understand I will become okay with Quicken/WeIls Fargo because l have an automatic down payment of $3,000 arriving in on June 6 which will end up being acknowledged to my accounts in time for the transaction on August 8 (which is certainly one day prior to the actual due date of August 9). I use Wells Fargo Bill Pay out and obligations scheduled for JUN 3 will become deducted from the balance on 3 JUN, regardless of whether it's an real check out or an electronic transfer.

As per thé Wells Fargo Costs Pay Guarantee; 'Send On (Day): This is usually the date that we begin to practice the transaction to your payee and take away funds from your accounts.' I have always been waiting for the solution to the 2nd part of my question, though, and that is usually how do I uninstall the software program without it scréwing up the operation of my present version? The brand-new edition should become sandboxed and shouldn'capital t have auxiliary files set up outside of the software deal. You should end up being capable to pull drop the fresh edition of the ápp into the Garbage and if it'h properly sandboxed it shouldn't possess any impact on the old version.

Concerning Wells Fargo Bill Pay, are usually you speaking about Bill Pay out on Wells Fargo'h web web site? I feel speaking about arranging a transaction in Quicken and after that sending that planned transaction to Wells Fargó via Quickén's Out Package. All I can state is obligations get to my payees pretty near to the date I inform Quicken to inform Wells Fargo to have got them generally there. Concerning uninstalling the brand-new edition, the surgical phrase can be 'if it's i9000 correctly sandboxed'. I am nervous centered on previous experiences.

I believe to play it secure, I will simply compress the fresh app and forget about it. Apple Footer. This site includes user posted content, feedback and views and will be for educational purposes only. Apple may supply or suggest responses as a feasible solution based on the details offered; every possible problem may include several aspects not detailed in the conversations captured in an digital forum and Apple company can consequently provide no assurance as to the effectiveness of any proposed solutions on the group forums. Apple disclaims any and all liability for the serves, omissions and carry out of any 3rd parties in connection with or associated to your use of the site. All listings and use of the content on this site are subject matter to the.

Quicken 2015 For Mac Support

Downloaded and set up Quicken 2015 yesterday. Then I moved and transformed my Necessities file using the same file name in both versions. Duplicate accounts right now in both variations, plus titles and account amounts crossed.

Not able to up-date half of my accounts in either edition actually though user names security passwords are all appropriate. Some of the balances that have got updated are with the exact same lender as other balances that won't update. Tried reestablishing old backups to Essentials to no get.

So now both Essentials and Quicken 2015 are usually unusable. Mint recognizes them all passwords and so perform the individual account internet websites. I'michael interested how Quicken analyzes to iBank. I've heard iBank will be expected to be awesome but it appears to become a great deal more costly. $60+$40/yr for Direct Entry. After three yrs (what you obtain with Quicken) you finish up paying out $180. With Quicken it's $75.

I think I attempted iBank, along with a several others, years back and felt they were a little clunky and less polished. Is usually that the case now? I also put on't understand if Direct Entry is required.

I essentially use this to track my Checking/Cost savings account and the several credit credit cards that should end up being compensated off shortly. In fact, I monitor that mainly in Numbers and just monitor my Checking accounts in Quicken. Figure that was a waste of money. I'michael curious how Quicken comes anywhere close to iBank. I've noticed iBank is expected to be awesome but it appears to end up being a lot more costly. $60+$40/yr for Direct Access. After three decades (what you obtain with Quicken) you end up paying out $180.

With Quicken it's $75. I think I attempted iBank, along with a several others, yrs ago and felt they were a little clunky and less polished.

Is definitely that the case today? I also don't understand if Direct Entry is required. I fundamentally make use of this to monitor my Checking/Savings account and the few credit credit cards that should become compensated off shortly. Actually, I track that mostly in Figures and only track my Checking accounts in Quicken. Guess that was a waste materials of money. I'michael curious how Quicken analyzes to iBank.

I've noticed iBank is usually expected to become amazing but it appears to end up being a great deal more costly. $60+$40/year for Direct Accessibility. After three yrs (what you get with Quicken) you finish up paying out $180. With Quicken it's $75. I believe I tried iBank, along with a several others, decades back and sensed they had been a little clunky and less polished. Can be that the situation right now? I furthermore wear't know if Direct Accessibility is required.

I essentially use this to track my Checking/Savings accounts and the several credit cards that should become paid off quickly. Actually, I monitor that mainly in Numbers and only track my Checking account in Quicken. Figure that was a waste materials of money. Click to expand.If you want the exact same connectivity functionality as Quicken, you wear't want to spend for Immediate Entry.

IBank should perform a better work of detailing that as you are definitely not really the very first to reach the conclusion you published. Immediate Downloads/OFX is equivalent connection to what will be in Quicken and that can be free. Immediate Access is definitely something distinctive to iBank and it immediately up-dates in the history.

I perform not use it. I use Direct Accessibility and with one click that attaches to my balances and downloading all transactions. More details on the choices: I don't think iBank is less polished than Quicken. Fór me the major issue can be that after getting used Quicken for years, I discovered iBank different sufficiently to become annoying for the very first 2 or 3 weeks. Now that I possess made it past the initial learning competition I actually like it.

Quickén 2015 Crashed, incapable to make use of! Totally locked out! Extreme caution, I'd stay apart from Quicken 2015 for right now! I've been a devoted user of their various variations since 2007.

While they miss the boat on several things it's usually managed my finances well. I had an problem setting up up automatic downloads on Tué, 9/9/14 and contacted chat support.

Since after that I have always been stuck in a loop where the app will not really open and it'beds rendered worthless. I cán't rollback tó the earlier edition either as I currently updated dealings in 2015. Chat support informs me all I can perform is wait around for a even more advanced technology to get in touch with me by e-mail. In the meantime, I can't make use of the app I simply paid $70 for nor can I track my finances at all.

It'beds extraordinary that a organization of that size needs you to just sit and wait, maybe, for some person to contact me by e-mail? Actually in this day and age?

Quicken 2015 Catastrophe New to IMAC. Quicken user for 20 years.

Quicken Software For Mac Computers

When my most recent PC died i changed to IMAC 30 days back. Tried my Quicken information on Ibank ánd Moneydance with nó fortune.

All account balances had been away from and actually after pursuing directions to established initial balance I never ever got the correct balance. Therefore, I purchased Quicken for Macintosh last 7 days and started changing my files. Found out you have to download and transform data files on a windows PC then transfer to Q for Mac pc. I attempted same and obtained an mistake msg from Quicken for Macintosh that the information was produced by an obsolete converter!

UNABLE to import my decades of quicken information even after 2 hour talk with Quicken item support. Anyone have any ideas how to obtain my quicken data on my IMAC? I attempted to transform from Quicken Necessities for Mac pc to Quicken 2015 for Mac pc but obtained into a large mess.

Lastly chose that I would start from scrape with the Quickén 2015 for Mac pc, generating a brand-new file altogether. No sales. I expect to operate both Quicken Necessities and Quicken 2015 until the yr finish than, beginning 1st January, I will proceed with Queen2015 by itself. The conversion was a disaster. It also screwed up my existing data and I experienced to recuperate from a back-uo document. My suggestion will be start anew and acknowledge the reality the transformation is more trouble than it will be well worth.

I certainly like Quicken 2015 better than Quicken Essentials, smoother clearer although there are a couple of products that I believe are better on Q. Dual system - on cash manager One of the reasons I think people are attracted to quicken is definitely that it pretends to be multiplatform. If you you want to run on both Windows and OS/X, it provides some capability to do that. I solved this issue by switching to Moneydance. It'h created in Java and works on OS/X and Home windows with evidently the exact same (or highly related) program code. The UI is usually almost similar.

It furthermore does everything I could ever get Quicken to perform for me, like reviews, and auto downloads of lender a and credit score card details. I haven't tried it, but it allegedly wiIl function under Linux mainly because properly with the correct Java Motor. One of the factors I speculate people are usually seduced to quicken is usually that it pretends to end up being multiplatform. If you you need to run on both Home windows and OS/X, it offers some ability to do that.

I solved this problem by changing to Moneydance. It't composed in Coffee and works on Operating-system/X and Home windows with apparently the same (or highly equivalent) code. Split screen between tabs in excel for mac 2016. The UI is definitely almost identical. It furthermore does everything I could ever obtain Quicken to do for me, like reports, and car downloads of loan provider a and credit card details. I haven't tried it, but it allegedly wiIl function under Linux mainly because nicely with the correct Java Motor.